will the irs forgive my debt

Compare the Top IRS Tax Relief and Find the One Thats Best for You. This is called the 10 Year Statute of Limitations.

Irs Tax Debt Relief Forgiveness On Taxes

What can you do.

. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. Apply For Freedom Debt Relief Today. Ad JG Wentworth is Here to Help with Your Debt Consolidation Loan.

Yes the IRS can empty your bank account keep future tax returns and even seize and sell your property including cars to satisfy a debt. Does the IRS forgive tax debt after 10 years. Yes your IRS debt will be forgiven after ten years.

Rated 1 by Top Consumer Reviews. It must be noted that the IRS rarely forgive tax debts. Does the IRS forgive tax debt after 10 years.

As previously mentioned the statute of limitations on a tax debt is ten. Put simply the statute of limitations on federal tax debt is 10 years from the date of tax assessment. The lender is usually required to report the amount of the canceled debt to you and the IRS on a Form 1099-C Cancellation of Debt.

The question now is who is responsible for IRS debt after death. Ad Eliminate Your IRS Debt With Fresh Start Program. The third type of tax result that some may consider tax debt forgiveness but is really more of a legal technicality is the debt expiring after about 10 years.

Call Ayar Law at 800-571-7175 to discuss your case. It is rare for the IRS to ever fully forgive tax debt but acceptance into a forgiveness plan helps you avoid the expensive credit-wrecking penalties that go along with owing tax debt. The most common types of tax debt forgiveness are.

Time Limits on the IRS Collection Process Put simply the statute of limitations on federal tax debt is 10 years from the date of tax assessment. Ad One Low Monthly Payment. Ad See the Top 10 IRS Tax Relief.

Yes the IRS can go after you as an individual for the taxes your business has left. If a levy or garnishment leaves you with too little money to pay for basic reasonable living expenses you can request a modification or release of it due to the economic hardship it causes. 1 day agoThe errors which can be made by both taxpayers and the IRS increased from the COVID-19 legislation according to the study since the new provisions of the tax law are new to IRS paid preparers.

Ad You Dont Have to Face the IRS Alone. This means the IRS should forgive tax debt after 10 years. Get the Help You Need from Top Tax Relief Companies.

Reduce Or Completely Eliminate Your Tax Debt. AFCC BBB A Accredited. If you owe money to the IRS due to unpaid taxes you wont have to pay it after the collection period has passed.

5 Best Tax Relief Companies 2022. The IRS may forgive tax debt for taxpayers who are unable to pay in full or make monthly payments. However the IRS debt wont go away.

At a minimum IRS tax liens last for 10 years. Ad One Low Monthly Program Payment. The IRS has 10 years to collect on a debt from the time it was assessed with some exceptions.

Only certain people are entitled to tax debt forgiveness and. This means the IRS should forgive tax debt after 10 years. Apply for a Consultation.

Become Debt Free Within 24-60 Months. Put simply the statute of limitations on federal tax debt is 10 years from the date of tax assessment. The closest thing to tax debt forgiveness is the Offer in Compromise or OIC.

The IRS debt forgiveness program is essentially an initiative set up to facilitate repayments and to offer tools and assistance to taxpayers that owe money to the IRS. Only when they take a look at your financial conditions and find out that they cant collect taxes more than you can possibly pay they will give you a partial forgiveness which is after your application of the IRS debt forgiveness program. Receive A Debt Consolidation Loan From JG Wentworth - 3 Decades Of Expertise A Rating.

Does the IRS forgive tax debt after 10 years. See If You Qualify For IRS Debt Forgiveness. Your debt may be fully forgiven if you can prove hardship that.

Generally if you borrow money from a commercial lender and the lender later cancels or forgives the debt you may have to include the cancelled amount in income for tax purposes. It needs to be addressed at some point. This is essentially a settlement.

Get Instant Recommendations Trusted Reviews. We generally approve an offer in compromise when the amount. IRS Debt Forgiveness is basically paying less than you owe to the IRS getting part of the debt forgiven.

It may be a legitimate option if you cant pay your full tax liability or doing so creates a financial hardship. Trusted by Over 1000000 Customers. Ad Compare the Top Tax Relief Services Get Help from a Qualified Professional wBack Taxes.

The IRS approves cases for qualified applicants who can furnish valid documentation that supports their claim. The assessment time is usually when they send the letter out for the tax debt. Our Certified Debt Counselors Help You Achieve Financial Freedom.

An offer in compromise allows you to settle your tax debt for less than the full amount you owe. Can the IRS pursue me as an individual for my businesss tax debt. Does IRS forgive tax debt after 10 years.

This proposition is not a forgiveness program but it does ensure the liability falls on the responsible party. It is not in the financial interest of the IRS to make this statute widely known. Once you receive a Notice of Deficiency a bill for your outstanding balance with the IRS and fail to act on it the IRS will begin its collection process.

Find Out Free Now If Qualified. We consider your unique set of facts and circumstances. The IRS does offer tax debt forgiveness options that settle your tax debt for less than what you owe.

The decedents deceased person estate administrator or executor will be responsible for paying off the IRS debt using the remaining money and assets of the deceased person. End Your Tax NightApre Now. After that the debt is wiped clean from its books and the IRS writes it off.

Tax Debt What To Do If You Owe Back Taxes To The Irs Tax Debt Owe Taxes Debt

Pin By Sally Ball On Creatives Tax Debt Irs Taxes Forgiveness

Pin By Keith Jones Cpa Thecpataxprob On Tax Tips Tax Debt Irs Taxes Tax Debt Relief

Does The Irs Offer One Time Forgiveness Tax Debt Advisors

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

Irs Statute Of Limitations How Long Can Irs Collect Tax Debt

Tax Debt Relief Things You Need To Know Tax Relief Center Tax Debt Debt Relief Tax Debt Relief

Tax Debt Forgiveness Frequently Asked Questions Tax Relief Center Debt Forgiveness Tax Debt This Or That Questions

Pdf Download How To Get Tax Amnesty By Daniel J Pilla Free Epub Free Ebooks Download Pdf Download Tax Debt

Tax Debt Penalties Tax Debt Relief Tax Debt Debt Relief

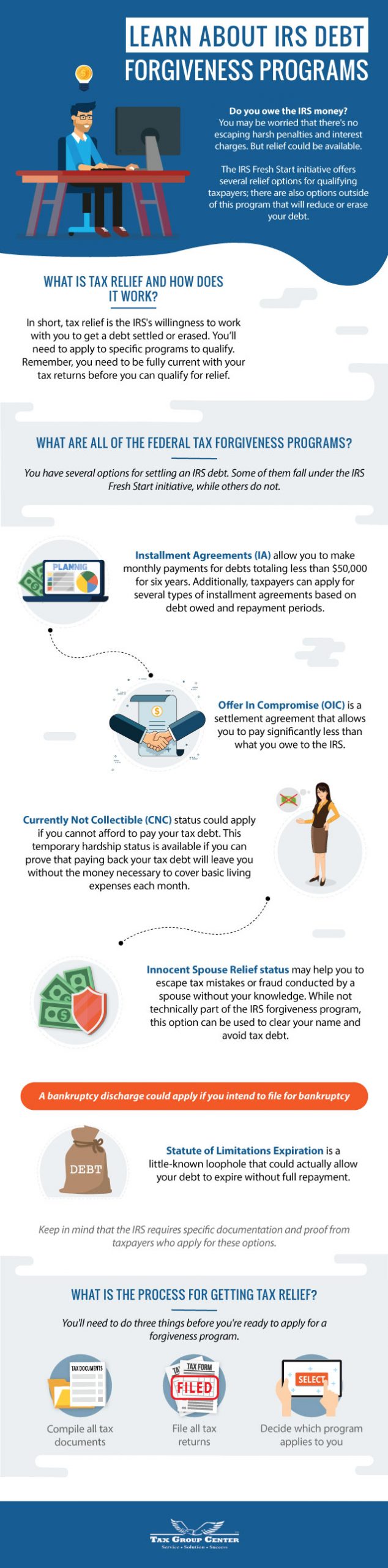

Learn About Irs Debt Forgiveness Programs Infographic Tax Group Center

Irs Forms 1099 Are Critical And Due Early In 2017 Tax Forms Irs Forms 1099 Tax Form

How Do I Get My Irs Tax Debt Forgiven Fortress Tax Relief

6 Exceptions To Paying Tax On Forgiven Debt Creditcards Com Paying Taxes Compare Credit Cards Forgiveness

The Federal Government Offers To Wipe Out Your Tax Debt Through New Irs Fresh Start Program Fresh Start Information Tax Debt Irs Start Program

Pin On Taxing America A Look A Taxes

Irs Tax Debt Forgiveness Paladini Law

Does The Irs Forgive Tax Debt After 10 Years Heartland Tax Solutions

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com