michigan gas tax increase history

Whitmers proposed three-step increase over a one-year period would give Michigan the highest fuel taxes in. Michigans gas tax is currently 263 cents per gallon for both regular and diesel fuel.

Pre Prohibition Local Coal Region Brew Beer Brewing Metal Signs

Oklahoma claims the lowest tax rate on aviation fuel at 00008 gallon.

. 1 Among the findings of this analysis. LPG tax is due on the 20th of April July October and January Quarterly tax except for motor fuel suppliers 20th of each month. Michigans diesel fuel tax was adopted in 1947 at a rate of five cents per gallon.

Michigan first enacted a fuel tax in 1925 at a rate of two cents per gallon. Michigan fuel taxes last increased on Jan. Each time you purchase gasoline in Michigan youre paying a couple of road-user fees as well.

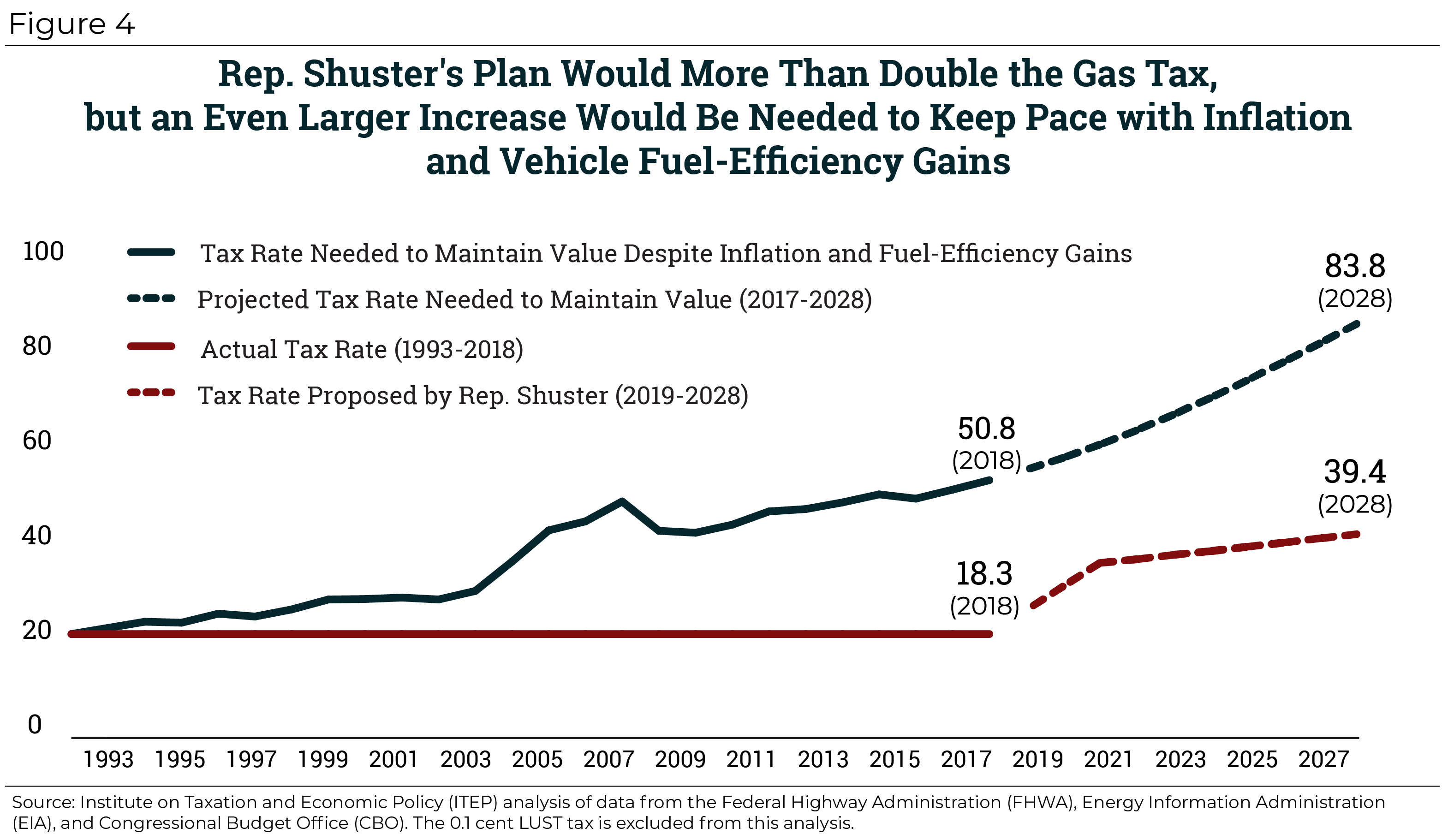

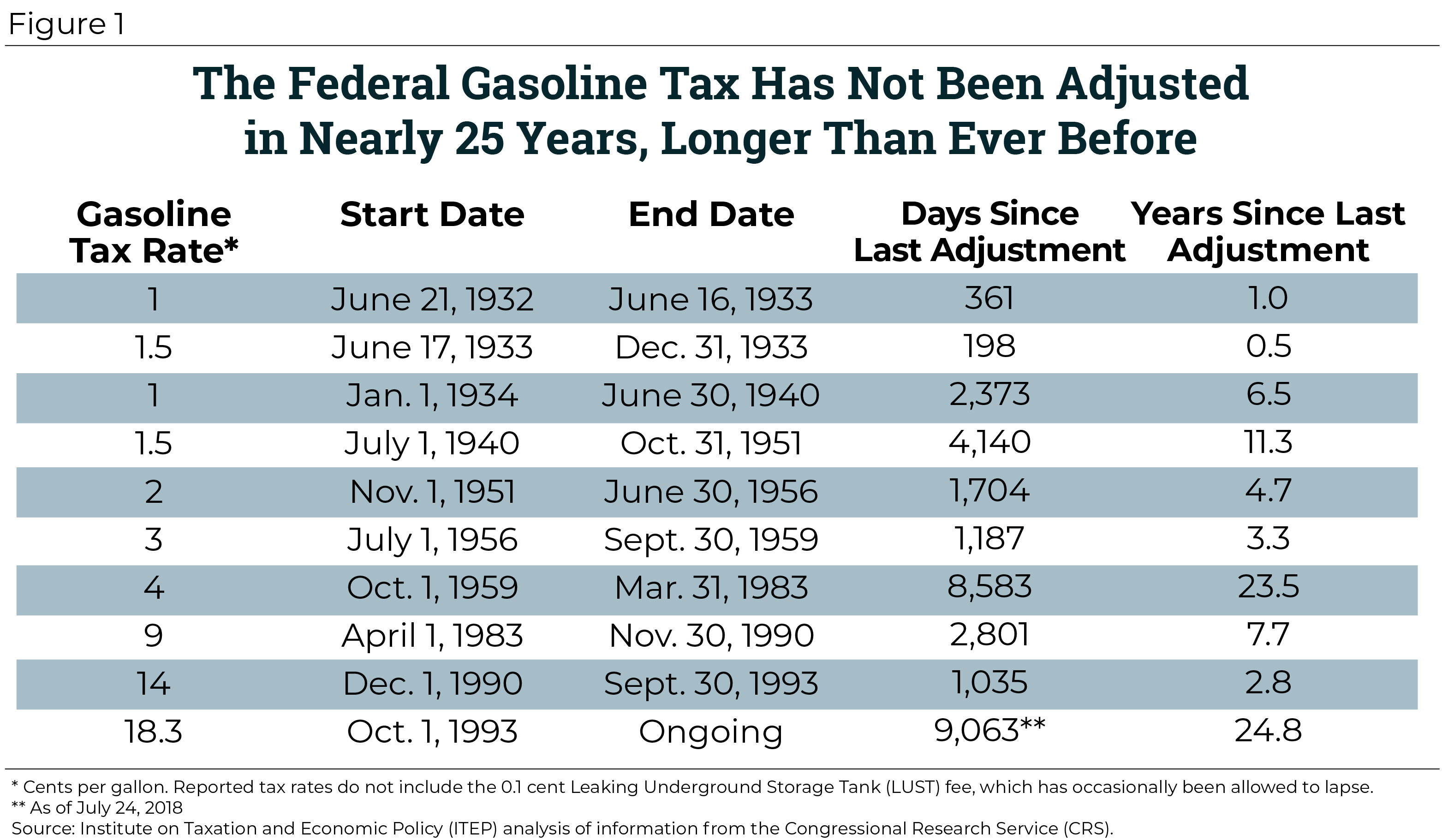

When fully phased-in this would represent a tax hike of around 12 billion at current wholesale fuel prices more than doubling current fuel taxes to 41 cents per gallon. Per gallon state gas tax and the 184 cents per gallon federal fuel tax. This chart shows the relative size of historic gasoline tax increases in Michigan Author.

Gas Tax rate can vary from 283-363 cpg depending on area Other Taxes include 2071 USTInspection fee diesel 125 cpg state sales tax 2196 USTInspection fee gasoline The state excise tax is 75 cpg on gas and diesel additional 138 ppg state sales tax on diesel 118 ppg state sales tax on gasoline. The chart accompanying this brief shows as of July 1 2017 the number of years that have elapsed since each states gas tax was last increased. A regulated natural gas utility serving southern and western Michigan.

Increase Nominal Dollar Increase Taxrate change. Zillow has 1489 homes for sale. Getting gas can be pricy depending on the vehicle and oil market but in Michigan drivers could be forced to shell out more at the station if a.

When those three taxes are added. But you also pay the Michigan 6 per - cent sales tax. However a push for raising the gas tax auto registration or both is seen by many as all but.

Thirteen states have gone two decades or more without a gas tax increase. Rick Snyder has made road funding his top 2013 agenda item and theres been some talk of lawmakers looking to existing resources to achieve the 14 billion price tag. And the states gas tax as a share of the total cost of a gallon of gas stood at 177 percent.

1 2017 as a result of the 2015 legislation. The state with the lowest tax rate on gasoline is Alaska at 00895 gallon followed by Hawaii at 016 gallon. Nineteen states have waited a decade or more since last increasing their gas tax rates.

Two years later in 1927 the rate was increased to three cents per gallon. At that rate Michigan motorists would pay 76 million more in the state gas tax each year starting in 2022. By Jack Spencer February 2 2013.

Michigan Fuel Tax Reports. The 187 cents per gallon state gas tax and the 184 cents per gallon federal fuel tax. Motorists here already pay the 184 cent per gallon federal gas tax.

In addition to state gas taxes which can make up between 5 percent and more than 20 percent of the cost of gas the federal government levies a tax of 184 cents per gallon 247. Based on retail price of 2746 per gallon Michigan average for regular gasoline during 2018. Whether gas costs 2 per gallon or 4 per gallon the amount collected for those two taxes remains the same.

To replace the current 19-cent per gallon gas tax and 15-cent diesel tax with a 95 percent wholesale fuel tax gradually increasing to 155 percent in 2018. This may well bring the annual increase close to the 5 maximum if not higher. As of January of this year the average price of a gallon of gasoline in Michigan was 237.

The tax on regular fuel increased 73 cents per gallon and the tax on diesel fuel increased 113 cents per. Is A Michigan Gas Tax Increase Inevitable. The lowest tax rate on diesel is 00895 gallon also from Alaska.

When gas is 389 per gallon that amounts to another 21 cents per gallon in taxes. Michigan fuel purchases are also subject to the 6 state sales tax. Fuel producers and vendors in Michigan have to pay fuel excise taxes and are responsible for filing various fuel tax reports to the Michigan government.

Oklahoma also enacts the lowest tax rate on jet fuel at the same rate 00008 gallon. View listing photos review sales history and use our detailed real estate filters to find the perfect place.

Driving Through Gas Taxes Carbontax Undergroundstoragetank Map Gas Tax Best Airfare Deals

State Motor Fuel Tax Rates The American Road Transportation Builders Association Artba

U S States With Highest Gas Tax 2021 Statista

Tywkiwdbi Cool Graphic Of Lake Baikal And The Great Lakes In 2021 Lake Baikal Great Lakes Lake

Fiat Chrysler To Put 1 Billion Into U S Jobs And Revive Jeep Wagoneer Chrysler Fiat Michigan

Rep Shuster S Mixed Bag Doubling The Gas Tax Before Repealing It Entirely Itep

Motor Fuels Taxes Diesel Technology Forum

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Rep Shuster S Mixed Bag Doubling The Gas Tax Before Repealing It Entirely Itep

Michigan Gas Tax Going Up January 1 2022

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

1924 Ad Antique Enclosed Hudson Coach Automobile Super Six Chassis Car Hudson Car Car Advertising Automobile Advertising

Fact 900 November 23 2015 States Tax Gasoline At Varying Rates Department Of Energy

United States Of Beer For Americans Who Partake In Alcohol Beer Is Still Drink Of Choice Vivid Maps Map Alcohol United States Map